Business Registration and Incorporations Services Back

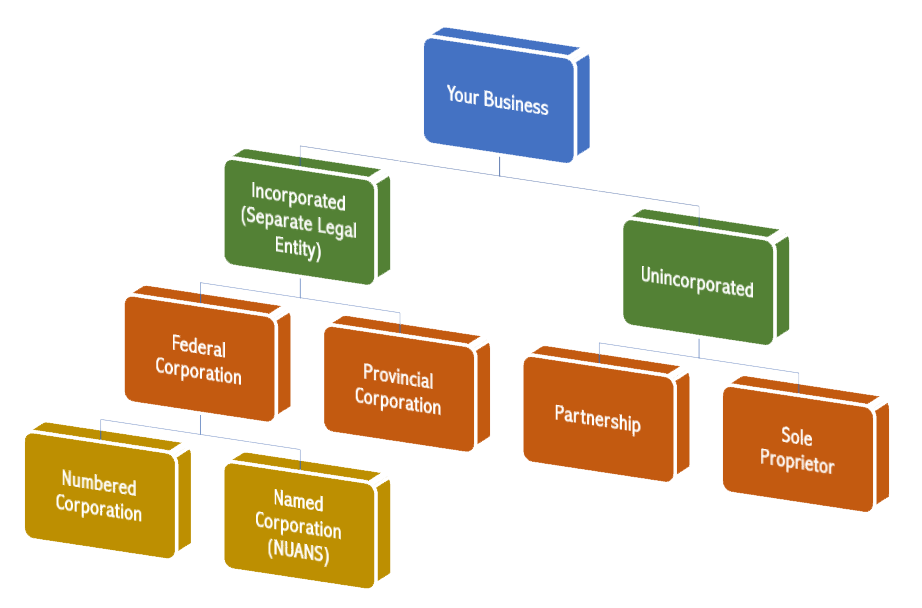

When you’re starting a new business, it’s worth the small investment to have experts handle it for you. We make business registration and incorporation simple, stress-free, and aligned to your objectives. Whether it’s a small sole proprietorship or the launch of a corporation, we have the expertise to simplify the process and get you off on the right foot with the appropriate type of business.

Our Services Include:

- Small Business Registration

- Sole Proprietorships

- Ontario & Canada Business Incorporations (most common)

- NUANS Name Search (for named corporations)

UNINCORPORATED BUSINESSES

Sole Proprietorship

A sole proprietorship is an unincorporated business owned by one person. It is generally viewed the simplest means of establishing and operating a company. Unlike a corporation, the business has no legal existence; it and its sole owner are one and the same for tax and corporate obligations. The owner is responsible for business decisions, generating profits, and also for assuming all associated risks and obligations. Owners include both the income and expenses of their sole proprietorship business on their personal income tax returns.

Partnership

Partnerships are relationships between two or more people conducting business with the intention of earning a profit. Many people will opt for a partnership due to its ease of formation and dissolution, and overall lack of formalities. However, as with sole proprietorships, a key disadvantage of the partnership model of business is the unlimited personal liability of individual partners for debts and obligations accrued by the business. Regardless of the contribution of capital by individual partners, each is liable for all debts incurred by the other partners through business activities. Additionally, owners may be held liable for the actions of employees in the course of their employment. Partners typically include both the income and expenses considering their ownership percentage of the partnership business on their personal income tax returns.

INCORPORATED BUSINESS – Most common

Incorporation describes a process in which a newly formed business entity is legally created for the purpose of protecting its owner/s from legal liability. The process of incorporation is governed by either the provincial or federal laws under which the corporation is established.

Benefits of incorporation

A separate legal entity

A Corporation is a fully distinct legal and tax entity from its owner(s). A corporation operates under its own rights, privileges and liabilities, and these are considered distinct from those of its owners or managers. Corporations are owned by their shareholders and typically managed and controlled by a board of directors. They will agree to the policies and transactions to be undertaken by the corporation and appoint all company officers. A corporation can be owned by one or multiple shareholders

Limited liability

A key advantage of incorporation is the way it limits the liability of its shareholders. Thus, shareholders of a corporation are typically not responsible for its debts. Should the corporation go bankrupt, individual shareholders will not lose more than their investment in it (unless such shareholders have provided personal guarantees for the corporation’s debts). As well, creditors cannot sue shareholders for debts or liabilities incurred by the corporation, despite those shareholders owning the corporation.

A notable exception is when a shareholder maintains another relationship with the corporation, for example, as a director. In this case he or she may, under certain circumstances, be liable for the corporation’s debts.

The Canada Business Corporations Act (CBCA) places a number of obligations and responsibilities on directors. An example of these is that directors may be held liable for certain acts or failures to act undertaken by the company.

Lower corporate tax rates

Corporations are taxed separately from their owners. And, since the corporate tax rate in Ontario is usually lower for small businesses (generally under 15% for the first $500,000 where corporation qualifies for small business deduction) than the personal tax rate, incorporating your business can offer valuable financial advantages. We invite you to ask us for advice on whether incorporation stands to lower your overall tax burden.

Continuous existence

A partnership or sole proprietorship ceases to exist upon the death of its owner(s). Whereas a corporation continues to exist legally, even if all shareholders and directors become deceased. The reason being, in the case of a corporation, that ownership of the business usually transfers to shareholders’ heirs.

The implied assurance of continuous existence confers greater stability on a corporation. This, in turn, allows the business to plan over substantially longer time frames, which may enable it to secure more favourable financing arrangements.

Business incorporation Services

Our team of professionals makes incorporation straightforward and compliant with both federal and provincial governmental regulations. We handle every part of the process, from filing paperwork to designing the most fiscally advantageous tax strategy, letting you focus on getting the business off the ground.

Benefits of working with us:

- Professional advice tailored to your industry & markets

- Clear explanation of all legal requirements

- Careful guidance through each step of the process

- Post-incorporation tax planning and setup