Corporation tax Back

A key aspect of business success and peace of mind is the application of a sound strategy for corporate tax planning. We encounter many business owners who are unaware of how to maximize their tax credits. They may miss important deadlines, make errors in tax computations, miss out on or overstate deductions. Such unnecessary errors will often result in heavy penalties.

As corporate tax accountants, we help your business safely steer through the vast array of regulations that apply to your specific industry. Our comprehensive approach ensures that you may optimize tax strategies for beneficial financial outcomes and comply with legal obligations. We are highly adept at seamless corporate tax filing, applying expertise to preparing and submitting accurate tax documents on time. We seek to maximize benefits in every corporate tax return through bespoke solutions that precision-fit each client’s unique business structure and goals.

As a full-service accounting firm, Pranav Dave Professional Corporation can serve as your corporate tax accountant to maximize tax savings while ensuring compliance though our expert corporate tax return preparation services. We specialize in Canadian tax law, with a focus on ensuring your business takes advantage of all permissible deductions and credits.

Our services include:

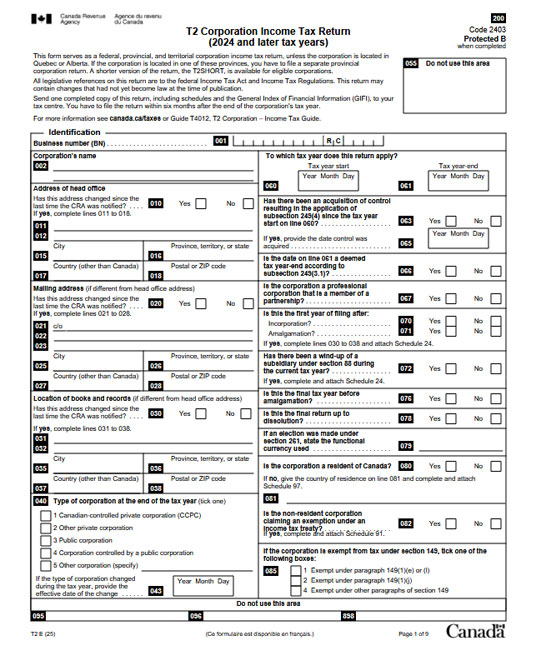

- Corporate Tax Return (T2) Preparation & Filing

- Corporation Tax Planning

- Filing nil returns for dormant or inactive companies.

- Salary vs Dividend Analysis & Recommendation

- Tax Return Adjustments, Reviews & Taxpayer Relief applications

- Assistance with Scientific Research & Experimental Development (SR&ED) Tax Credits

- Section 85 rollovers